Financial Decision Support

Quick answers to your questions about building better money habits, making investment decisions, and creating financial security that actually works for Australian families.

Common Concerns

Most people ask similar questions when they're trying to improve their financial situation. These categories cover the real issues that keep families up at night – from everyday budgeting to retirement planning.

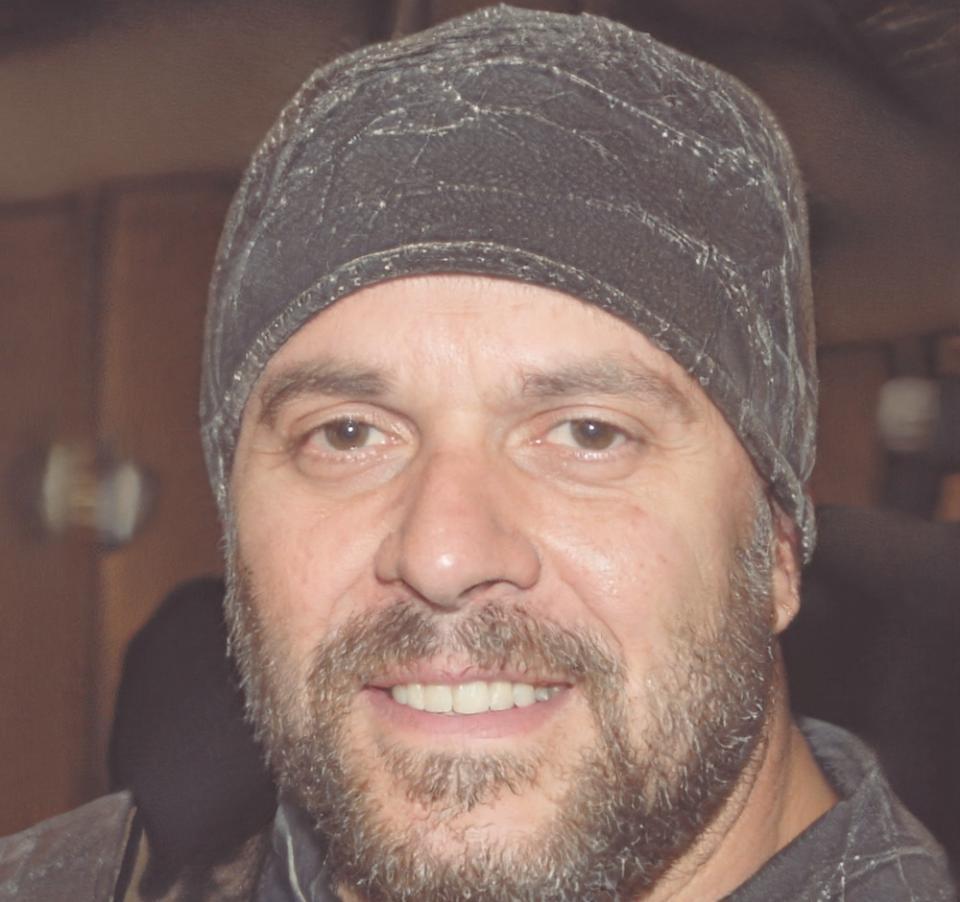

Marcus Caldwell

Senior Financial Advisor

Budget & Cash Flow

Managing monthly expenses, tracking where money goes, and finding room for savings without cutting everything you enjoy.

Investment Basics

Getting started with shares, understanding risk, and building wealth through property and other investments suitable for your situation.

Property & Mortgages

Home buying decisions, refinancing options, and using property equity wisely in Australia's changing market conditions.

Insurance & Protection

Choosing the right coverage levels, understanding what you actually need, and avoiding over-insurance or dangerous gaps.

Frequently Asked Questions

How much should I save each month?

There's no magic number that works for everyone. Most Australian families can start with 10-15% of their after-tax income, but your situation matters more than any formula. If you're paying off high-interest debt, focus there first. If you're comfortable with expenses, you might push savings higher. The key is consistency over perfection – even $100 monthly builds momentum.

Should I pay off my mortgage early or invest?

This depends on your mortgage rate, investment timeline, and risk tolerance. With rates around 5-6% in 2025, paying extra mortgage principal gives you a guaranteed return equal to your rate. Investing might provide higher returns over decades, but comes with volatility. Many people split the difference – some extra payments, some investing. Your peace of mind matters as much as the math.

How do I start investing with limited money?

You can begin with as little as $500 through low-cost index funds or ETFs. These give you exposure to hundreds of companies without picking individual stocks. Start with broad market funds, add money regularly, and resist the urge to check performance daily. Time in the market typically beats timing the market. Focus on building the habit first, optimizing strategy second.

What insurance do I actually need?

At minimum: adequate health cover, home and contents insurance, and car insurance if you drive. Life insurance becomes important when others depend on your income. Income protection insurance replaces earnings if you can't work due to illness or injury. Skip exotic products and focus on covering real risks that would create financial hardship. Review annually as your situation changes.

When should I get professional financial advice?

Consider professional help when you're making big decisions like buying property, changing careers, receiving inheritance, or planning retirement. Also worthwhile if you're struggling to manage debt, your finances feel overwhelming, or you want objective perspective on your strategy. Good advisors pay for themselves through better decisions and peace of mind. Look for fee-for-service rather than commission-based advice.

How much emergency fund do I need?

Aim for 3-6 months of essential expenses, but build gradually. Start with $1,000, then work toward one month's expenses, then three months. Keep it in high-interest savings accounts where you can access it quickly. Your target depends on job security, family situation, and other safety nets. Self-employed people typically need larger buffers than those with stable employment.

Real Support for Better Decisions

Our approach focuses on helping you understand your options rather than pushing specific products. We believe informed clients make better long-term financial choices.

Clients improve financial confidence

Years helping families